Reload Forex Card Online

Owing to globalization and the internet, international boundaries are blurring. With more and more people traveling abroad, the demand for forex cards is surging. However, one of the main hassles of using a travel prepaid card is reloading it. If you are going for an international trip and are looking for an easy reload forex card, then choose only Thomas Cook. If your itinerary includes multiple countries, then we’ve got an ideal travel card for you. Our Borderless Card allows you to load ten different currencies in a single card, eliminating the need to carry different travel cards or bearer currency of different countries

Benefits of Thomas Cook Forex Card

Some of the benefits of using Thomas Cook forex cards include:

1. Global access: Shop, eat, and travel worry-free with Thomas Cook. You can enjoy access to over 34 million merchants across the globe. That’s not all, you can even access various MasterCard ATMs worldwide and get instant cash.

2. Protection from exchange rate fluctuation: Thomas Cook not only offers the best deals on flights, hotels, and forex cards, but also provides the best currency exchange rates in the market. Stay safe from fluctuating forex rates by locking your exchange rates at the time of loading your prepaid travel card.

3. Safety: Carrying cash on you could leave you constantly worried. However, with forex cards, you can travel tension-free. Our cards come with a chip and PIN protection to ensure you don’t fall prey to any thefts or frauds during your international trip.

4. Easy reload: If you run out of cash during your overseas trip, you will face the trouble of hunting a reliable forex vendor and end up paying an exorbitant exchange price. This will not only burn a big hole in your pocket, but could also take away the joy from your trip.

However, with forex cards, you don’t have to lose your sleep over running out of foreign exchange. With an easy reload option, our travel cards are a proven choice for my travelers across the world. To reload forex prepaid cards, simply log on to the Thomas Cook website, select the ‘Reload Forex Cards’ option, fill in the required details, and the rest will follow. If you wish, you could also visit the nearest Thomas Cook branch with the required documents to swiftly and effortlessly reload prepaid forex cards. Still have concerns regarding reloading a forex card? Speak to our forex experts today on our toll free number 18002099100.

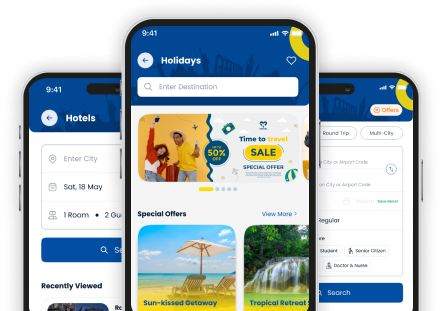

How to Reload or Top Up a Forex Card?

If you are planning to travel to multiple countries when you step out, a borderless prepaid card is almost a mandatory requirement nowadays. But, on a long trip, it may be difficult for you to anticipate the total expense and hence convenient reloading options become crucial.

To reload Forex card of Thomas Cook :

1: Visit website

2: Provide card details with the amount and currency denomination

3: Enter traveller details and upload documents

4: Make your payment via net banking, debit and credit cards or UPI

5: Confirm your order and your card will be reloaded at a blocked rate.

Alternatively, you may also visit the Thomas Cook branch to top up Forex card that you have by submitting fresh forms and documents.

Our Forex Offerings

Education Forex

Thomas Cook has always been a forerunner when it comes to supporting students who dream of studying abroad. For years it had catered to forex and remittance needs for students including university and course application fee payments, Multi-currency cards for students, to recharge forex cards, remittance for maintenance and education and insurance and Forex Currency notes.

If your son or daughter needs guidance about financial requirements to study abroad, look no further. They will be counselled and supported for it, from the beginning till the day they start earning.

Forex Cards

Be it One Currency Cards or Borderless Prepaid Multicurrency Cards, Thomas Cook’s travel cards make your international travel cost-effective and hassle-free. You can now go on a shopping spree and indulge yourself at a merchant outlet or withdraw local currency from any ATM around the globe. It further offers smooth online top-ups, which can be done anywhere around the world, giving you the freedom to experience the best when you travel.

Other Foreign Exchange Products

Besides One Currency Card, Borderless Multi-currency card and Student Forex as detailed already, Thomas Cook also offers currency notes of 26 world currencies. Though prepaid cards seem convenient and almost a norm nowadays, cash can be a saviour in areas where transaction amounts are smaller, like paying for taxis, leaving tips for services and paying parking fees etc. All you need to do is visit the website or send a “Hi” on WhatsApp at 8879142236 and you will have your required cash amount at your doorstep. Use the online currency converter to find the best time and buy rates. You need not worry about your unspent foreign cash. You can sell your foreign currency to Thomas Cook and get back your local currency for further usage.

With such options and ease of transactions, Thomas Cook is committed to effortless and smooth travel experiences.

Find the Right Thomas Cook Forex Card for Your Travels!

One Currency Card – Simple & Cost-Effective

- Load in USD and spend worldwide with zero cross-currency conversion fees

- Accepted at 35.2 million+ MasterCard merchants globally

- Insurance cover up to INR 7,50,000 for added security

Borderless Prepaid Card – For Multi-Destination Travelers

- Carry up to 9 currencies on a single card

- 25% off on tours & activities with Klook

- Lounge access at international airports in India

Study Buddy Card – Designed for Students

- Free International Student Identity Card (ISIC) for global discounts

- Reload funds instantly while abroad

- Insurance cover up to USD 10,000 for financial protection

EnterpriseFX Card – Ideal for Business Travelers

- India’s first eco-friendly forex card, made from recycled plastic

- Earn TC Edge Reward Points on transactions

- Complimentary lounge access at international airports