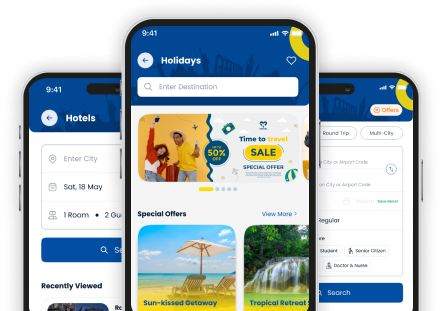

Thomas Cook is a renowned name in the travel industry, offering pre-planned and customised

tour packages across the world. Not just travel packages, we aim at providing competent services in money exchange in Ahmedabad as well. Our objectives for

currency exchange in Ahmedabad are:

Reliable – We offer seamless and streamlined services in money exchange in Ahmedabad, like we do for all our locations.

Reasonable – Our customers can be assured that our services in foreign exchange in Ahmedabad is aligned with the existing foreign exchange rates. For instance, if you apply for money exchange now, you will receive it as per the exchange rate today.

Online and offline services – If you choose the online option, you can visit our official website and select the services that you want. Our expert customer executives will assist you with your requirements for foreign exchange in Ahmedabad. If you prefer the offline option for money exchange in Ahmedabad, you can visit any of our branches where our representatives will help you with the procedure.

Customer satisfaction – Our efforts in money exchange in Ahmedabad brings us closer to our aim of ensuring customer satisfaction through all products and services.