The

Kuwaiti Dinar is the official currency of the Kuwait many travellers from different walks of life exchange the KWD for their travel purpose be it leisure, business, or education. The Kuwaiti Dinar can be carried in many different modes such as

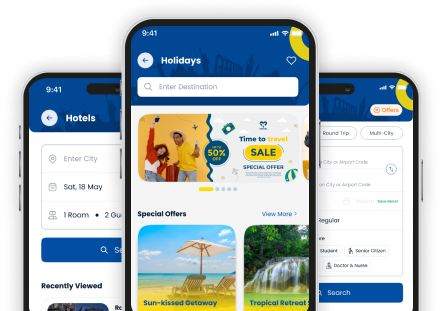

currency notes , forex card . With Thomas Cook forex services one can easily buy or sell the Kuwaiti Dinar currency at their desired price, by following our live forex tool on the website. This tool is available round the clock and the customers can book their desired rate from anywhere, anytime. To make sure that our customers have a delightful experience, we deliver the forex right at their doorstep post completion of the forex process. Thomas Cook provides its customers with the best Kuwaiti Dinar buying rate. There are several other currencies for which Thomas Cook offers its forex services. All the currencies are facilitated by us not just in currency notes but also via other products like the

forex cards - one and multiple currencies, and currency notes. Get the best

Kuwaiti Dinar rate in India today by clicking on our website and avail the best available offers exclusively for our customers. Customers can even compare the rates offered by other sites and place the order online, as we give the best Kuwaiti Dinar rate today that too delivered right at their doorstep. Our team of experts will ably assist our customers with all the necessary information to ensure that the exchange process is seamless.