Looking for the best Dollar to the Rupee exchange rate ? We are here for all your forex requirements. Converting USD to INR could be a hassle, especially after returning from one of the most memorable international trips.

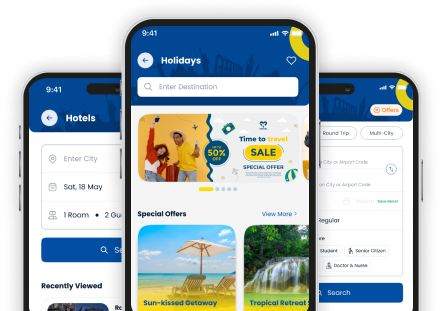

Just like the U.S., Thomas Cook has a solution for all your travel concerns. From converting INR to USD, finding the best flight and hotels deals, to reconverting USD to INR, and several other International Tourism solutions, we have got you covered.

Head straight to our online money converter assistant that provides you real-time USD to the INR exchange rate.

Still, have concerns regarding selling forex? Our forexexperts are available to help you sell forex and get the best Dollar to Rupee rate.

Importance of the US Dollar One of the strongest currencies across the globe, the US dollar is the world’s reserve currency. With a deep-rooted history in the United States of America, the US dollar is the official currency of several other countries. Being a world currency, US dollars can be used and also exchanged for any other currency within as well as outside the border of any country.

For almost a hundred years, the size and strength of the US economy have supported the stability of the US dollar. Its depth and liquidity across the global market are unmatched. As per the IMF, International Monetary Fund, the US dollar made up almost 60% of all the known central bank

foreign exchange reserves. It is estimated that by 2020, there was $2.04 trillion in circulation. The widespread confidence in the dollar encourages countries and investors to save and retrieve it in the future without the risk of any significant loss.

Introduction of the US Dollar

The initial use of the US dollar currency note can be traced back to 1690, however, the official dollar sign $ was adopted in 1785. The banknotes were published to fund the ongoing 1861 Civil War. Because of the green colour of the notes, the notes were called greenbacks.

The responsibility of handling new banknotes was given to the OCC, Office of the Comptroller of the Currency and the National Currency Bureau which were established in 1863. After almost ten years of the creation of the Federal Reserve, that is 1890, the US Treasury took the duty of issuing legal tenders. After the Bretton Woods Agreement of 1944, the U.S. dollar evolved as the reserve currency and was funded by the largest gold reserves, making many other countries invest in the US dollar.

Factors that affect the exchange of the US Dollar to INR

The exchange rate between two countries, also called the conversion rate, refers to the rate at which they can be exchanged. When it comes to the country’s international trade, the exchange rates play a crucial role.

The exchange rate between the US Dollar (USD) and Indian Rupee (INR) is an important indicator of the economic health of both countries. Inflation, public debt, rates of interest, current account deficit, political stability and overall economic outlook are some of the crucial factors that affect the exchange of the US Dollar to INR. High inflation along with budget deficits of the government can weaken the position of the Indian Rupee. The economic.

Convert US Dollar to INR Online as per Today’s Conversion Rate Today’s rate of US Dollar to INR is 81.99. Let's understand how this rate would affect your Forex transaction, with the help of an illustration:

37-year-old Nikita Jain works in New York. For her brother’s birthday, she wishes to make a money transfer of USD 100.

As per the rate of exchange, USD 1 equals INR 81.99. So for the USD 100 that she sends, her brother would receive INR 8,209.

Convert US Dollar to INR

A currency converter helps in the easy and accurate conversion of US dollars to INR. Understanding the conversion rate would help you make informed decisions about currency conversions involving the US dollar and INR.

The current rate of US Dollar to INR is 81.99 The expected High Low is 0.19% For 1 US Dollar, you would receive roughly INR 82.

INR 1 = $0.012 INR 100 = $1.22.

How are US Dollar-INR Rates Determined? The US Dollar (USD) and the Indian Rupee (INR) are two of the most widely traded currencies in the world. The exchange rate between these two currencies, which is quite popular, is determined by a variety of factors, including macroeconomic conditions, geopolitical developments, and investor sentiment and government policies.

In 1947, when India became a member of the IMF, the Indian Rupee was at par with the US dollar, however today we need to spend about INR 82 to buy a dollar. India. Like many other countries, it had to devalue its currency in order to manage its Balance of Payment. Also, currency devaluing encourages exporters to export more.

US Dollar and INR Overview

India’s centralised currency, INR is monitored and controlled by the Reserve Bank of India, RBI. Currently, a one-rupee coin is the smallest currency used in the country. In 2010, the country finally got its official symbol of ₹. To fight the problem of black money, the government announced demonetisation of banknotes of ₹500 and ₹1,000, after which ₹500 and ₹2,000 was ordered.

A US dollar equals a hundred cents. The Federal Reserve System, the so-called Central Bank of America monitors the US currency. Introduced in 1792, the US dollar is one of the most dominant currencies in the world today.

When the US dollar rate increases, the INR takes a hit and vice versa. The foreign exchange rates between two countries can keep fluctuating on a daily basis. It is highly recommended that before you buy foreign currency or making a translation, make sure to calculate the prevalent rates.