Currency Exchange Rate Today Information

Are you planning your next international travel? If yes, then first and foremost things that you must consider is arranging for the country’s foreign exchange. Experts believe that travel currency cards or travel forex cards are more convenient and economical. The exchange rates are indicative and subject to change as per the market movements. Check out the Thomas Cook India foreign exchanges rates for NRI services and remittances.

How to check the Currency rate card?

The Currency rate card table shows buy, sell and remittance rate for various currencies. Depending on your requirement (buy or remit), you can check how much INR you'll need for buying or remitting. Similarly, if you want to sell a currency, the table shows how much INR you'll get by selling a foreign currency.

What are buy Rates for Travel Card and Cash?

Buy rates for travel card and cash are rate at which you'll be able to buy 1 unit of foreign currency. If you are going on foreign vacation to US America, you'll need US dollars. This can be transferred as travel card or you can carry cash. If buy rate of 1 US dollar is Rs. 69 for Travel card and Rs. 70 for cash, this means you'll have to pay Rs.69 to get 1 US dollar in your travel card, or if you want to carry cash you can pay Rs. 70.

What is Sell Rate?

Sell rate is the rate at which you'll be able to sell foreign currency and get equivalent Indian Rupees. If sell rate of US dollar is Rs. 68, this means when you sell 1 US dollar, you'll receive Rs. 68

What is Remittance Rate?

Remittance means transfer of money from foreign country to home country (India). Remittance rate is the rate of that foreign currency against Indian Rupees. For example, if remittance rate for US dollar is 70, this means 1 US dollar being remitted is equivalent to Rs. 70.

Locked-in exchange rates

One of the most important concerns in foreign exchange is its fluctuating conversion rates. Since Forex travel cards are loaded at locked-in exchange rates, they protect you from the fluctuating exchange rates. This way you maximize the value of your rupee. For example, if you have loaded your travel prepaid card with 20,000 USD, the value of it won’t change, regardless of the foreign exchange fluctuations.

Why Choose Thomas Cook?

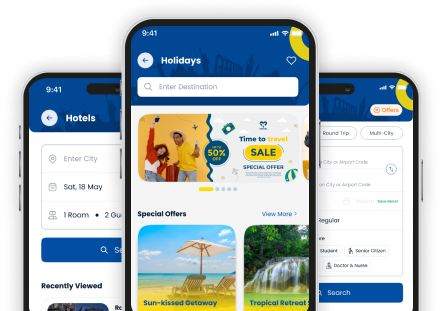

When you think international travel, think Thomas Cook. At Thomas Cook, we understand the value of your money and the importance of a good vacation. With our exhaustive range of travel services, we aim at enriching your travel experience. Our services include, but are not restricted to, flight booking, hotel booking, sight-seeing and foreign exchange. The world is constantly evolving and in today’s digital era, buying foreign currency has become as simple as ever. With just a few taps, you can effortlessly check the exchange rate and accordingly buy your prepaid travel card online or cash at the most competitive prices.

Another concern in availing foreign exchange is finding a reliable source. Our constant efforts at enriching your travel experience with our bespoke solutions, have helped us reach a reputable position in the international travel and forex market. Leisure and business travelers from across the world trust us for all the forex requirements. Our transparent processes and seamless experience have helped us gain the trust of millions around the globe. What are you waiting for? Check the live rate card and buy travel card or cash at the most competitive prices now and gear up for your upcoming overseas trip

Find the Right Thomas Cook Forex Card for Your Travels!

One Currency Card – Simple & Cost-Effective

- Load in USD and spend worldwide with zero cross-currency conversion fees

- Accepted at 35.2 million+ MasterCard merchants globally

- Insurance cover up to INR 7,50,000 for added security

Borderless Prepaid Card – For Multi-Destination Travelers

- Carry up to 9 currencies on a single card

- 25% off on tours & activities with Klook

- Lounge access at international airports in India

Study Buddy Card – Designed for Students

- Free International Student Identity Card (ISIC) for global discounts

- Reload funds instantly while abroad

- Insurance cover up to USD 10,000 for financial protection

EnterpriseFX Card – Ideal for Business Travelers

- India’s first eco-friendly forex card, made from recycled plastic

- Earn TC Edge Reward Points on transactions

- Complimentary lounge access at international airports

Frequently Asked Questions About Forex Rate Card

What is the card rate in forex?

The card rate is the exchange rate applied when a currency is loaded onto your Forex card. Thomas Cook provides live forex rates for various currencies that you can check on the website.

What is today's rate?

You can check today's live forex rates for different currencies on Thomas Cook's official website.

How is the forex market today?

The forex market rates fluctuate in real time. For the most current rates and market conditions, it's best to check the forex rate tool live on the website.